Warranty Cost: An Introduction

Whether your company is marketing commercial products or selling to the Government, warranties are an important ingredient to competitive success. Effective warranty planning can ensure success, but lack of attention to cost analyses can spell disaster. This article is intended to introduce the basics of warranties and to identify sources for more information.

A warranty is the seller’s assurance to the buyer that a product or service is as represented. Anexpress warranty is one where the terms are explicitly stated in writing and an implied warranty is one where the seller automatically is responsible for the fitness of the product or service for use according to the Uniform Commercial Code.

Generally, three types of warranties are common for consumer goods: (1) the ordinary free replacement type, (2) the unlimited free replacement type, and (3) the pro-rata type. As the names imply, under the first two types, the seller provides a free replacement with the distinction between the two being that with type (1) the warranty on the replacement is for the remaining length of the original warranty while with type (2) it’s for the same length as the original warranty. With the pro-rata type, the cost of the replacement depends on the age of the item at the time of replacement. Because the free replacement types seem to be most advantageous to the customer and the pro-rata most advantageous to the seller, a mixed policy type is often used as a compromise. With this type, there’s an initial period of free replacement, followed by a period of pro-rata policy.

Warranty planning includes a number of decisions starting with whether the product is repairable or non-repairable. The determining factor in deciding which applies to the product of interest usually depends on the ratio of the repair cost to the acquisition price. Once this decision is made, the type of warranty, the length of the warranty, and the funds required to cover the costs have to be determined. Often, the warranties offered by competitors in a particular product market weigh heavily on these decisions. At this point you may be wondering why warranties are a topic for the “Reliability Ques” series. It really shouldn’t be a surprise because the single most important parameter in estimating the warranty cost is the rate at which the product is expected to fail. Usually, an initial estimate of the reliability based on predictions or similar products’ experience is used to project costs, with a later switch to the analysis of actual warranty claims from an internal tracking or Failure Reporting and Corrective Action (FRACAS) type system.

Simple Warranty Example: Let’s assume that a manufacturer of GPS devices plans to offer a 6-month warranty on the devices that cost $100 each to produce. The expectation is to sell 10,000 devices and an internal test program indicates that the Mean-Time-To-Failure (MTTF) is 5 years after a stress-screening period. How much should the production cost be increased to cover the warranty cost?

W=6 months

C0=$100 (without warranty cost)

MTTF=60 months

N=10,000 units

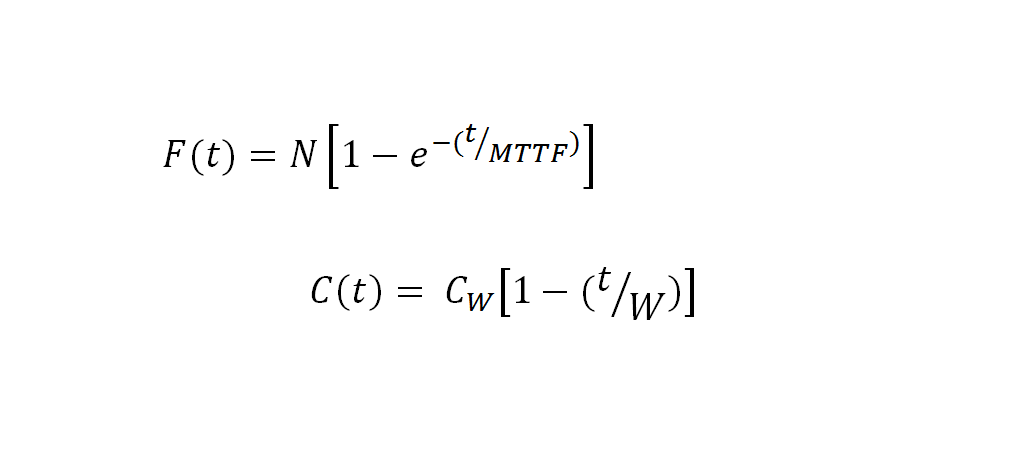

The expected number of failures is:

So that the number of failures over the interval dt is:

![]()

The cost of failures is:

![]()

So that the warranty reserve cost is:

Where CW is the cost of including the warranty cost, so:

Therefore, the added warranty reserve fund per unit, per dollar cost CW, is:

But, the production cost plus warranty cost:

![]() or

or

![]()

Therefore, the total warranty fund required would be:

This article is a very brief introduction to warranties with the following recommended references: (1) Blischke and Murthy “Product Reliability Handbook”, Dekker, 1996 and (2) Elsayed, “Reliability Engineering”, Addison Wesley Longman, 1996.